The Nuclear Decommissioning Authority's ability to manage large procurements has been called into question by the National Audit Office (NAO). In its report on the 'Magnox contract', issued today, the NAO assesses the competitive procurement exercise for services to decommission two nuclear research sites and 10 Magnox sites that the NDA ran between 2012 and 2014.

The NAO scrutinises public spending for Parliament and is independent of government. The NDA is an executive non-departmental public body sponsored by the Department for Business, Energy & Industrial Strategy (BEIS).

Earlier this year, the NDA announced the decision to terminate its contract with Cavendish Fluor Partnership (CFP) for the management and decommissioning of 12 redundant Magnox sites. In a written ministerial statement to the House of Commons on 27 March, Energy Secretary Greg Clark said there was a big difference between the contract with CFP and the work that is required.

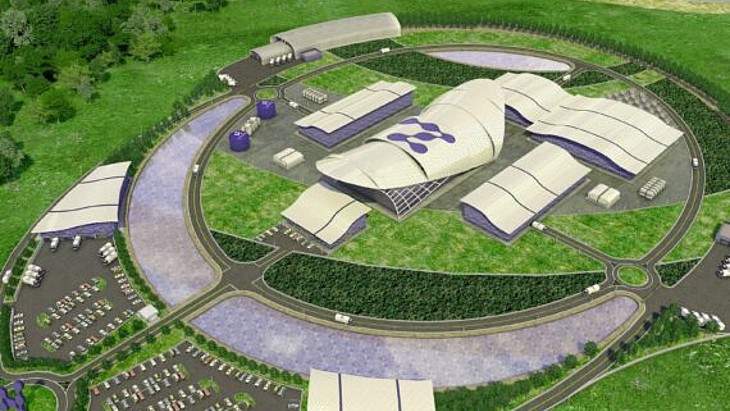

CFP is a joint venture between the British firm Cavendish Nuclear, a subsidiary of Babcock International, and the US company Fluor Inc. The sites affected by the contract, together with the Calder Hall reactor on the Sellafield site, formed the UK's first fleet of nuclear power plants. CFP won the 14-year contract in September 2014 in a GBP6.1 billion ($7.7 billion) tender the NDA started in April 2012. This decision was approved by the then Department for Energy and Climate Change (DECC) and the Treasury.

Failures

The 'Magnox contract' is among the largest by value put out to tender by the UK government, the NAO noted. The Treasury approved the competition and contract award on the basis that the new contract would provide savings of at least 10%, it added. The report is intended to support the Committee of Public Accounts' consideration of the events surrounding the contract.

"The NDA's fundamental failures in the Magnox contract procurement raise serious questions about its understanding of procurement regulations; its ability to manage large, complex procurements; and why the errors detected by the High Court judgement were not identified earlier," Amyas Morse, head of the NAO, said in a statement accompanying the report.

"In light of these issues," Morse added, the BEIS "must consider whether its governance and oversight arrangements surrounding the NDA are sufficiently clear and effective in providing the scrutiny and assurance it requires to meet the standards expected in managing public money."

The High Court found in July last year that the NDA had wrongly decided the outcome of the procurement process and the NDA agreed to settle claims in March this year. Energy Solutions, one of the incumbent contractors for the Magnox sites until 2014, unsuccessfully bid for the contract, and subsequently issued legal claims against the NDA for damages. The High Court found that, had the NDA applied its evaluation criteria correctly, the winning bidder, CFP, would have been excluded from the competition, the report says. The NDA agreed to settle legal claims with Energy Solutions and its consortium partner at the time of the bid, Bechtel, at a cost of GBP97.3 million.

For the procurement, the NDA Board relied on assurance reviews and legal advice that did not detect problems later identified in the High Court judgment, the NAO said.

"While defending the legal claims, the NDA was progressing a complex process of contract 'consolidation' with CFP. The NDA describes this contractual process as a 'truing up' between what the contractor was told to expect and what it actually found upon taking over responsibility for the sites," it said.

During consolidation, the expected costs of decommissioning the Magnox sites increased from GBP3.8 billion in CFP's winning bid in 2014 to GBP6.0 billion in 2017. The NDA attributes GBP0.7 billion of this increase to a revised understanding of the volume of waste and asbestos on the sites, which it says could not be quantified before work under the contract began, the report notes. Another GBP1.0 billion of the increase was expected by the NDA when it awarded the contract, but GBP0.5 billion was not expected.

The contract provided for the consolidation process to last 12 months and conclude by September 2015, but it continued without resolution until March this year, the report said. The NDA agreed to extend the contractual deadline to complete consolidation from September 2015 to March 2016 because of the volume and complexity of the changes required to the scope of the contract.

From May 2016 onwards, the NDA received legal advice on the risk of legal challenge created by the changes proposed to the contract since it was awarded in 2014. The volume of changes proposed to the contract left the contract vulnerable to legal challenge and the NDA's proposed approach to concluding consolidation in June 2016 "would have made it more difficult to defend any legal challenge on the grounds of material variation to the contract", the report said.

In March, the Secretary of State announced the NDA's decision to terminate the contract with CFP nine years early, due to a "significant mismatch" between the work specified in the tendered contract and the work that needs to be done. On 29 September, the NDA, with approval from the Secretary of State, served notice of termination to CFP, effective from 1 September, allowing for a 24-month notice period, ending 31 August 2019. The NDA says it is considering options for how the Magnox sites should be managed once the contract with CFP comes to an end.

The NDA said on 29 September that it had reached agreement with CFP on the work to be performed on the sites during the contract's remaining two years, as well as the arrangements and agreed state in which CFP will leave the sites at the end of the contract. It added: "The NDA continues to believe that this is the best course of action for the taxpayer, removing the legal risk and ensuring the continued safe, secure operations of the sites."

Actual costs

Before terminating the Magnox contract, the NDA forecast 13% cost savings (GBP904 million) compared with the previous contracts, the report said. The NDA believes that so far, CFP has reduced costs by around GBP255 million relative to the old contracts.

For the consolidation process, certain formal governance arrangements were not in place until August 2015, a month before the contractual deadline to complete the process, the report said.

Three reviews commissioned by the NDA assurance director cited significant risks with the consolidation process from December 2015. The reviews were shared with the programme's senior responsible owner and the NDA's chief financial officer, but the NDA Board was only informed of findings from the third review, the report said.

BEIS, UK Government Investments (UKGI) and the Treasury were aware of delays to the consolidation process and the increase in the cost of the contract, "but raised no formal concerns" to ministers until August 2016, it said. A government company wholly owned by the Treasury, UKGI was set up to be government's specialists in corporate governance and corporate finance.

The Treasury and UKGI told the NAO that they were concerned about the delays in consolidation, but relied on assurances provided by the NDA that a resolution would be achieved. From October 2016, a cross-government group of senior officials, including the chief executive of the civil service, and officials from the Treasury, BEIS, UKGI and Government Commercial Function, met seven times to discuss the issues the NDA faced with litigation and consolidation, according to the report.

The NAO estimates that the Magnox contract cost the taxpayer "upwards of" GBP122 million.

The NDA agreed to settle legal claims with Energy Solutions and Bechtel at a cost of GBP97.3 million. It also spent GBP13.8 million on legal and external advisers. Of this, GBP3.2 million was spent on the competition and GBP8.6 million was spent on legal fees in the ensuing litigation, according to the report. The NDA estimates that in-house staff time has cost GBP10.8 million. This excludes the cost of staff time of senior central government officials who were heavily involved in decisions, particularly about the NDA's settlement and its decision to terminate the contract, it said.

The Secretary of State for BEIS announced on 27 March the government would set up an inquiry into the Magnox contract led by Steve Holliday, the former chief executive of National Grid. The inquiry is ongoing.

Union calls for change to role

The GMB trade union said today the NAO report proved the NDA "should be scrapped in its current form" and re-designated as the Nuclear Development Agency.

The NAO concludes that the decommissioning authority’s commercial strategy for dealing with nuclear waste is “wholly inappropriate” and needs to be redrawn, the union said.

Justin Bowden, GMB National Secretary for Energy said: "We need to cut out the middle men and have this work done in-house to cut costs and to save the taxpayer money.”

Researched and written

by World Nuclear News