Anatolia Energy expects to start full-scale development at Temrezli before the end of 2015 after a pre-feasibility study (PFS) revealed better-than-expected economics for the high-grade uranium project in eastern Turkey.

.jpg) |

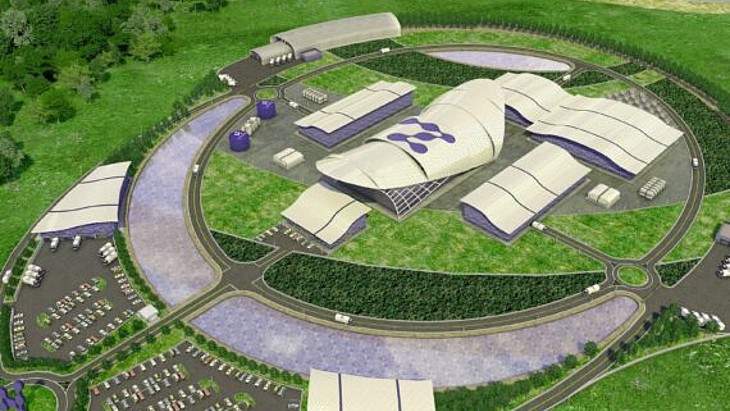

| Exploration work at Temrezli (Image: Anatolia Energy) |

The independent PFS was carried out by Tetra Tech and confirmed the proposed in situ leach (ISL) project to be technically low risk as well as highly profitable. Based on the development of the deposit's measured and indicated resources, which total 11.3 million pounds U3O8 (4347 tU), plus the development of some 80% of Temrezli's 2 million pounds U3O8 (769 tU) of inferred resources, the PFS foresees a total output of 9.9 million pounds U3O8 (3808 tU) over a mine life of 12 years, at a cash operating cost of $16.89 per pound U3O8. The initial capital cost for developing the site would be $41 million, with project payback within the first 11 months of operation.

According to Australian Anatolia, the figures will position it as one of the world's lowest cost uranium producers.

The company plans to construct a central processing plant at Temrezli, with an annual capacity of 1.2 million pounds U3O8 (462 tU). The plant could also process uranium-loaded resin from future satellite operations such as the nearby Sefaatli project, where Anatolia is about to start the second phase of a drilling program which should lead to initial resource estimates.

Temrezli is about 200 km east of the Turkish capital Ankara, and the project will benefit from existing local infrastructure including roads and power lines. Anatolia describes the estimated $7.3 million cost of life-of-mine infrastructure as small relative to other ISL uranium projects. The company hopes to further reduce up-front costs by using Turkish plant suppliers where possible.

Anatolia CEO Paul Cronin noted that the test work completed during the PFS had seen many upgrades to the project since a preliminary economic assessment was completed in 2014, leading to better financial returns than previously anticipated. "The strong economics of the project, even at today's term uranium price provides a robust foundation," he said.

With an operation licence already in hand, Anatolia now needs to complete an environmental and social impact assessment (ESIA) before applying for an operation permit. The ESIA is already in preparation, with the first stage expected to be submitted for approval by the end of February.

Subject to finance, Anatolia expects that full-scale development will begin this year and says it plans to begin some pre-development activities immediately.

Turkey currently imports much of its energy, but work on its first nuclear power plant is expected to begin later this year. The Akkuyu plant, which will eventually comprise four Russian-designed VVER-1200 reactors, is to be built, operated and financed by Russia's Rosatom.

Researched and written

by World Nuclear News