Investors have been asked to propose a new future for Canada's state nuclear reactor technology business outside of state hands. Existing project partners are thought the most likely buyers.

AECL is the developer and lead builder of the Candu pressurized heavy-water reactor and it is AECL's Candu reactor division which is coming up for sale. The crown corporation also has a research and technology division which manages sites such as Chalk River on behalf of the state. Proposals for the future of that include one from staff themselves.

"AECL's Candu reactor division needs strategic investors to take full advantage of this opportunity, strengthen its global presence and reduce the financial risks carried by taxpayers," said natural resources minister Lisa Raitt.

|

Qinshan III 1 and 2: AECL Candu reactors completed on time and |

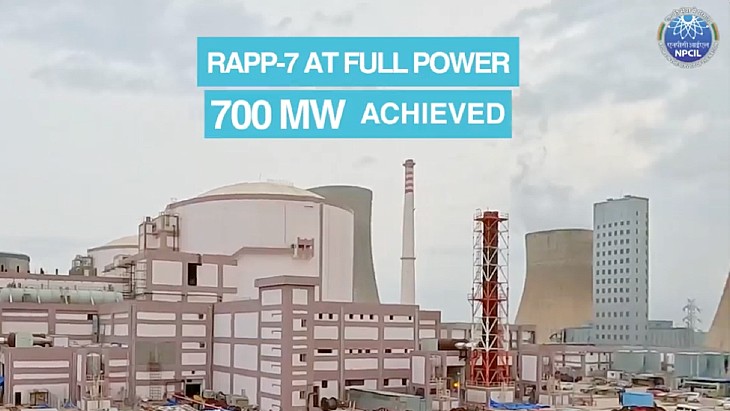

There are 44 Candu units operating worldwide, most are in Canada but the list of owners includes Nuclearelectrica of Romania, Korea Hydro and Nuclear Power, Nucleoelectrica of Argentina and China National Nuclear Company. The two Chinese units were completed only in 2002 and are thought to be the best performing in the world.

However, these reactor make up only about 10% of the global fleet and with no orders to build the Candu reactor division is seen mainly as a services business. As well as routine maintenance, Candu unit require extensive refurbishments after about 30 years of operation.

AECL does not have an extensive manufacturing capability and instead partners for big projects with a group of firms dubbed Team Candu. The principle members of this are Babcock & Wilcox, GE-Hitachi, Hitachi Canada and SNC-Lavalin and these are expected to show interest in the sale.

At the time the restructuring was announced its objective was to "leverage Canada's long-term investment in nuclear energy and strengthen Canada's nuclear industry at a time of global expansion." It had been concluded that AECL's crown status as a joint research and technology vendor "prevents AECL from accessing capital markets and making equity investments." AECL is supported to a certain extent by government funds, with the country's 2009 budget including a sum of C$351 million ($367 million) for AECL. The nuclear industry in Canada counts some 30,000 highly skilled workers and Raitt said the government is committed to retaining these jobs as well as creating more.

The company has worked on an advanced version of the Candu called ACR-1000 but this is not yet ready for order and is now unlikely to develop further. The Canadian Nuclear Safety Commission has accepted the design as meeting overall safety goals in a pre-licensing review. UK regulators reached a similar point in assessment before AECL deferred participation in the market in order to concentrate on Canadian opportunities in Aptil 2008.

At that time some seven ACR-1000s were being discussed for the provinces of Ontario, New Brunswick and Alberta. A drop in power demand on the financial crisis has seen all Canadian new build initiatives stall, with the exception of Ontario Power Generation's plans for two large reactors at Darlington, for which a technology decision is yet to be made.