The cost of nuclear power is in line with other baseload energy technologies, but new nuclear power plants can generate more electricity and more cheaply over their full lifetime if financing costs are low. This is the conclusion of a recent joint study by the OECD Nuclear Energy Agency (NEA) and the International Energy Agency (IEA).

Projected Costs of Generating Electricity: 2015 Edition is the eighth edition of the IEA and NEA's joint study of the levelised lifetime costs of generating electricity for a broad set of generation technologies. The 2015 study focuses on the expected costs of technologies being built now and commissioned by 2020. The study has been published at varying intervals since 1981, with the last edition dated 2010.

The forward-looking study calculates the levelised cost of electricity (LCOE) using discount rates of 3%, 7% and 10%, using a combination of generic, country-specific and technology-specific assumptions agreed by a steering expert group to calculate costs at the plant level. The report is based on data for 181 plants in 22 countries, including three non-OECD countries (Brazil, China and South Africa), including natural gas, coal, nuclear, solar voltaic, onshore and offshore wind, hydro, geothermal, biomass and combined heat and power plants. There is a marked shift in the data set towards renewables compared to previous reports, which the authors say indicates an increased interest in low-carbon technologies on the part of the participating governments.

Birol takes helm

Fatih Birol today took office as the IEA's executive director. Birol joined the IEA in 1995 and most recently held the positions of Chief Economist and Director of Global Energy Economics, with responsibility for the IEA's World Energy Outlook publication. His appointment to replace Maria van der Hoeven was announced in February.

For baseload generation - combined cycle gas turbine, coal and nuclear - the study found nuclear to be the lowest cost option or all countries at a 3% discount rate. However, nuclear plants are more capital-intensive than either gas or coal, and this is reflected in increasing projected costs for nuclear at the 7% and 10% discount rates. Overnight costs for nuclear technologies in OECD countries ranges from $2021 per kWe of capacity (in Korea) to $6125 per kWe (in Hungary), but the levelised costs of electricity from nuclear, at the 3% discount rate, range from $29 per MWh (Korea) to $64 per MWh (United Kingdom). At the 7% discount rate the range increases to $40-101 per MWh and at 10% to 51-136 per MWh.

The data also suggests that an increase in the costs of baseload generation noted in the 2010 report has halted. This is particularly notable for nuclear technologies, "undermining the growing narrative that nuclear costs continue to increase globally", the report concludes.

Emerging nuclear

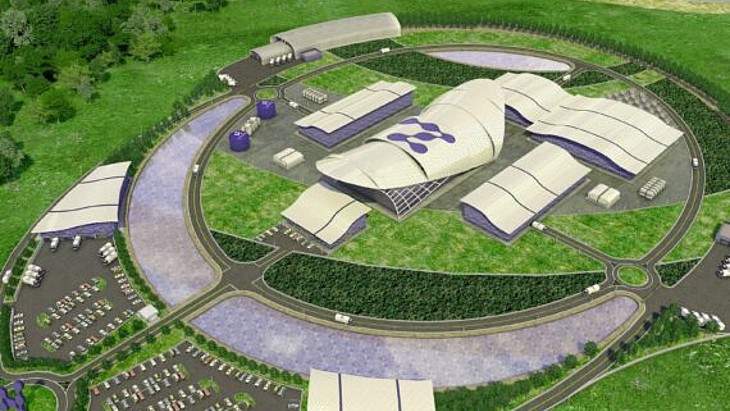

The report looks into the cost and deployment perspectives for small modular reactors (SMRs) and generation IV reactor designs - including very high temperature reactors and fast reactors - that could start being deployed during the 2015-2030 time frame. Although it finds that the specific per-MW costs of SMRs are likely to be 50% to 100% higher than those for large generation III reactors, these could be offset by potential economies of volume from the manufacture of a large number of identical SMRs, plus lower overall investment costs and shorter construction times that would lower the capital costs of such plants. "SMRs are expected at best to be on a par with large nuclear if all the competitive advantages … are realised," the report notes.

Generation IV technologies - the report highlights China's prototype high-temperature reactor and sodium-cooled fast reactor prototypes - aim to be "at least as competitive as generation III technologies" in terms of generation costs. Additional benefits over generation III reactors, in terms of fuel utilisation and waste management or high thermal efficiency, also offer potential economic advantages over other alternative technologies.

Finally, life extension of existing nuclear power plants also needs to be considered in the discussion, the study finds. "While not an emerging technology in the strict sense, since the technologies involved are well known, this constitutes an emerging issue in the nuclear power industry," the report states. As a large number of existing nuclear plants approach the end of their initial 30- or 40-year design lifetimes, major refurbishments - and the associated major capital investment costs - should be factored in.

No simple solutions

The report finds that the levelised costs of renewable technologies, especially solar photovoltaic, have declined significantly over the past five years and can produce electricity at close to, or even below, the costs of new fossil-fuelled power stations.

Nevertheless, the cost drivers of the different technologies still vary across the individual market and technology and the report's authors urge caution over drawing broad lessons from its analysis. "As such, there is no single technology that can be said to be the cheapest under all circumstances. As this edition of the study makes clear, system costs, market structure, policy environment and resource endowment all continue to play an important role in determining the final levelised cost of any given investment," the report concludes.

Researched and written

by World Nuclear News

_97013.jpg)