Total global energy investment totalled USD1.8 trillion last year, a 2% decline in real terms from 2016, the IEA said in its newly-published report, World Energy Investment 2018. The power generation sector accounted for most of this decline, owing to fewer additions of coal, hydro and nuclear power capacity, which more than offset increased investment in solar photovoltaics, according to the IEA. More than USD750 billion was spent on the electricity sector last year, while USD715 billion was spent on oil and gas supply. After several years of growth, investment in renewables and energy efficiency declined by 3% in 2017.

Of the four new reactors commissioned last year, three were in China. More than 5 GWe of nuclear generating capacity was retired, leading to a net reduction of about 2 GWe in total nuclear capacity worldwide. Capacity was still about 10 GW higher than in 2007. While around 60 GWe of nuclear power remains under construction worldwide, new construction starts totalled just over 3 GWe.

Modernisations and upgrades of existing reactors represented about half of total nuclear investment last year. "Large investments have recently been made in OECD countries to extend lifetime operation and power uprates of the existing nuclear fleet," the IEA said. "In general, spending on existing plants yields more output per dollar invested."

Over the past five years, nuclear plants with a total capacity of over 40 GWe have obtained permission to extend their operational lifetime beyond 40 years, the report notes. Investment over that period averaged around USD7 billion - three times more than over the previous five years.

"Assuming these plants run an extra ten years, generation from lifetime extensions over the past five years is equivalent to 15% of expected lifetime output from solar PV and wind investments over the same period, at just 3% of the cost," the IEA said. "At 20 years of long-term operation, the output from these upgrades would be equivalent to one-third of expected lifetime output from the solar PV and wind investments."

The IEA suggests that lifetime extensions could be "a cost-effective transitional measure for maintaining low-carbon generation in the face of uncertainties for new nuclear plant development or that for other low-carbon sources". However, it notes that such extensions require "supportive regulatory and technical factors".

Access to both direct and indirect government finance remains vital for investments in nuclear power, the report says. "Most investment in new nuclear capacity has occurred in markets where the government retains full ownership or a majority stake in most of the utilities." Investment in nuclear power also remains highly dependent on government involvement in various areas, including market structure, price regulation and financing.

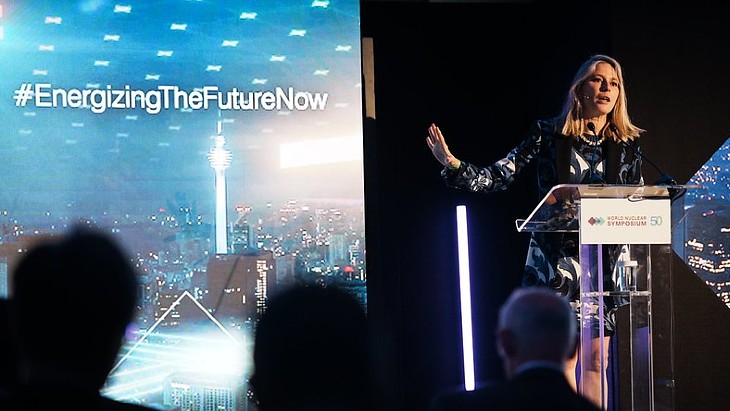

World Nuclear Association Director General Agneta Rising told delegates at the Atomexpo 2018 conference in Sochi in May: "In the five years from 2015 to 2019 we should see 55 new reactors start in 12 countries, two of those countries hosting their first nuclear power plant. With a combined capacity of 55 GWe this new nuclear generation will avoid the emission of more than 400 million tonnes of carbon dioxide each year, compared to coal. It is equivalent to adding nearly 15% to global nuclear capacity," she said.

The Harmony goal, put forward on behalf of the nuclear industry by World Nuclear Association, is a vision of a future energy system where nuclear energy supplies 25% of global electricity demand by 2050 as part of a low-carbon generation mix, which would require 1000 GW of new nuclear build. This will need a level playing field in energy markets, optimising all existing low-carbon energy resources already in place and driving investment in future clean energy, as well as an effective safety paradigm focusing on genuine public wellbeing.

.jpg)

_69614.jpg)

_15447.jpg)