With nuclear new-build investment set to top some $1.5 trillion by 2030, the World Nuclear Association (WNA) has launched an in-depth report assessing the role and development of a robust and reliable supply chain to support the growing nuclear power sector over the next two decades.

|

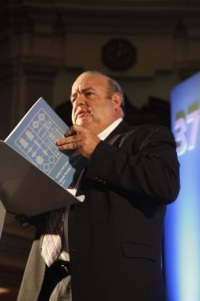

| Juan Molina presents the report at the WNA Symposium |

The World Nuclear Supply Chain: Outlook 2030 looks at the challenges and opportunities presented by plans for a total of 160 new units to enter service by 2030. It builds on work from the WNA's biennial Global Fuel Market Report, taking three scenarios for nuclear generating capacity to illustrate the range in size of the potential market for nuclear power plants.

The 154-page report was unveiled at the WNA's 37th annual symposium in London by Juan Molina, who chairs the WNA's Supply Chain Working Group as well as being chief procurement officer for Westinghouse.

Over $500 billion will be spent globally on international procurement to support nuclear new build over the next two decades, WNA estimates. Nine consolidated vendors today offer much of the technology and services that support the entire nuclear fuel sector, alongside a handful of other significant players, mostly engineering companies. Emerging industrial economies, such as China and India, are open to international procurement (albeit with governments keen to maximize locally manufactured content), and the supply chain that is evolving to support nuclear plant construction is an internationally diverse one.

A new reactor requires around 200 complex or heavy forgings, and only a few presses in the world have the capacity to accept ingots of the necessary size. But a nuclear plant also requires millions of other components: a modern light water reactor requires over 2000 km of cabling, 210 km of piping, 5000 valves and 200 pumps. Further, in addition to those components that must be of 'nuclear' grade, a nuclear plant requires a host of so-called commercial grade components and structures, ranging from the turbogenerator systems to the staff canteen. There is plenty of scope for competition, although new suppliers of nuclear-grade components must gain the necessary accreditation before they can enter the market, especially if they are manufacturing safety-critical components.

There is currently ample capacity in the supply chain, documented comprehensively in the WNA report. As Molina explained, a reliable, robust and international supply chain can work to reduce cost pressures, in part by reducing supplier bottlenecks, while a large global market will boost investment, and a diverse range of players in the market will encourage innovation.

The report makes a considered analysis of the multifaceted nuclear industry supply chain, including areas in which developments can work to strengthen not only the supply chain but the whole nuclear industry: standardization of reactor designs and consistent safety requirements, harmonization to a more coordinated system of supplier certification and monitoring of nuclear grade component manufacturers, harmonization of trade and export/import regulations, and developing the supplier base are some of the supply chain strengthening measures highlighted in the report.

The nuclear industry is already taking action, Molina noted. Two WNA working groups - the Supply Chain working group and the working group on Cooperation in Reactor Design Evaluation and Licensing (CORDEL) - are actively working on areas including defining a common vendor approach to supplier certification, convergence in mechanical design codes and standards, and contributing to the development of guidance and best practice on licensing and permitting.

"We need to find a way to make it easier for our suppliers, and ourselves, to do what needs to be done," Molina said. "We can make things easier for the industry and the world."

Researched and written

by World Nuclear News

_33198.jpg)

_730_93825.jpg)

_83147.jpg)