Following the completion on 23 July of the sale of a 25% stake in the Langer Heinrich uranium mine to China National Nuclear Corporation (CNNC), Paladin Energy has finalised a refinancing deal to for the Namibian project that will save it $32 million over three years.

CNNC subsidiary CNNC Overseas Uranium Holding Ltd agreed to purchase a 25% joint-venture equity stake in the Namibian project for $190 million in January. As part of the deal, an offtake agreement guarantees CNNC the option to purchase its pro-rata share of Langer Heinrich's uranium output at the prevailing market spot price.

Paladin went on to announce that it had agreed a refinancing package with its existing lenders after using proceeds from the sale to prepay $30.38 million of its existing Langer Heinrich finance facility. The facility places the existing finance facility - $110 million before the drawdown from the sale - and $20 million working capital facility into a new syndicated loan facility worth $70 million.

According to Paladin, the new facility will provide "significant cash flow benefits" and reduce the company's annual principal repayments by $32.4 million over the first 3.5 years of the study.

The finance facility is provided by Namibian and South African banks including Standard Bank of South Africa, Standard Bank of Namibia and Nedbank Capital, which have been involved with financing the Langer Heinrich project since 2006.

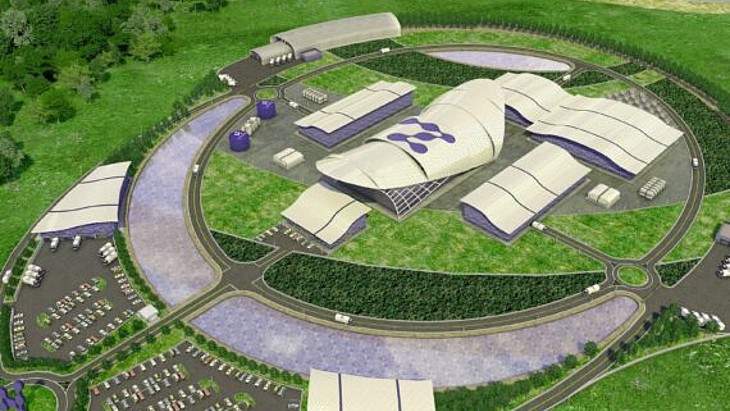

Langer Heinrich came into operation in 2006 and produced 1.393 million pounds of U3O8 (536 tU) in the first quarter of 2014.

Researched and written

by World Nuclear News