Increasing demand for uranium would help commodity producer BHP Billiton to remain strong in a carbon-constrained world, according to a newly published analysis of the potential effects of climate change on the multi-commodity company's portfolio.

BHP Billiton's report, Climate change: portfolio analysis, published on 29 September describes the company's scenario planning approach, including the potential portfolio implications of a transition to a so-called 2°C world, where the global average temperature increase stays below 2°C relative to pre-industrial levels. Such an increase underlies the International Energy Agency's (IEA) 2 Degree Scenario (2DS) - the main scenario in the agency's Energy Technology Perspectives 2015 that describes the actions needed in the energy sector to limit the rise in global temperatures to no more than that level.

BHP Billiton is a major producer of iron ore, metallurgical coal, copper and uranium, and has substantial interests in conventional and unconventional oil, gas and energy coal.

"By sharing our analysis of BHP Billiton’s portfolio in a 2°C world, we believe investors will be able to decide how well BHP Billiton is equipped to manage climate risk," chief commercial officer Dean Dalla Valle said.

Speaking at the report's launch, Dalla Valle identified providing emerging economies with access to affordable energy and resources, while responding to climate change to limit temperature increases, as the two critical challenges facing the world. "Achieving these goals would entail substantial changes to the global economy. Companies in all sectors will have new market opportunities, face new competitors and all will need to find new ways of working," he said.

The company has developed four long-term scenarios against which to test the resilience of its portfolio and investment options, reflecting "plausible and divergent ranges" in global growth, levels of trade, geopolitics, technological innovation and climate change responses. The report recognizes that while there are many ways in which the world could transition to a 2°C world, ranging from an orderly transition through global accord to a "shock" event triggering a rapid decarbonization effort. Energy is likely to be the most affected sector whatever the transition route: as a key source of global emissions it is likely to face strong environmental regulation, which will lead to further efficiency improvements within the sector itself and increasing competition between fuels.

"In a 2°C scenario, we expect the demand for most of BHP Billiton’s products will continue to rise in absolute terms. As the energy mix changes, copper, gas and uranium could see stronger demand than otherwise would have been the case," Dalla Valle said. "Together these factors would help offset weaker demand, lower prices or higher costs in other areas of our portfolio such as energy coal," he added.

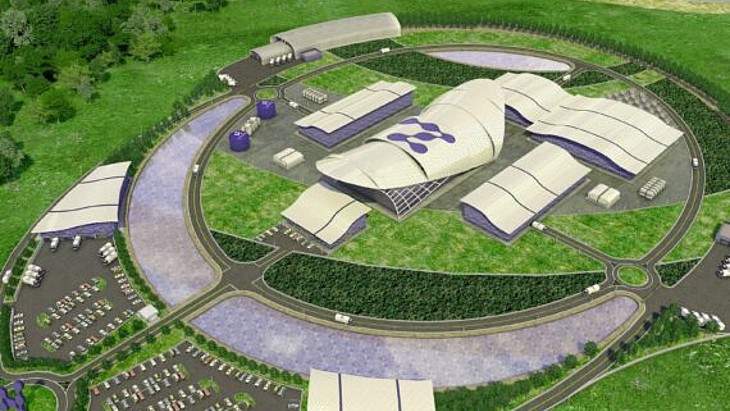

BHP Billiton's portfolio includes the Olympic Dam mine in South Australia, where uranium is produced as a by-product of copper. For non-energy commodities, the report anticipates increased recycling and the rise in environmental costs to be key drivers. However, global consumption of copper - Olympic Dam's primary product - will increase in a low-carbon environment due to rising demand for energy efficient technologies such as copper-intensive solutions in the power and machinery sectors, the report notes.

Olympic Dam was the world's third largest uranium producer in 2014, accounting for 6% of world output. In November 2014, the company announced plans to increase the mine's output of copper by 27% from 2018.

The report also outlines the steps the company is taking to reduce the greenhouse gas emissions from its own operations, including investing in the development of low-emissions technologies and supporting market mechanisms that provide financial incentives for the private sector to achieve emissions reductions and sustainable development.

The company has set itself the target of keeping absolute emissions for fiscal 2017 below the baseline level of fiscal 2006.

Researched and written

by World Nuclear News

_97013.jpg)